If you’re a business owner looking for quick capital, you may have come across the term is forward funding legit. With various financing solutions available in the market, it’s natural to question the authenticity and reliability of forward funding. In this blog, we will explore what forward funding is, how it works, its benefits and risks, and whether it is a trustworthy option for your business.

What is Forward Funding?

Forward funding is a financing method where a lender provides capital to a business upfront, which is then repaid based on future revenue. Unlike traditional loans, which have fixed monthly payments, forward funding repayments are flexible and depend on the business’s cash flow. This type of funding is popular among businesses that experience fluctuating revenue, such as retail stores, restaurants, and service providers.

How Does Forward Funding Work?

The process of forward funding is relatively simple:

- Application and Approval: A business submits an application with its financial details, including revenue, expenses, and banking history.

- Funding Offer: Based on the financial health of the business, the lender provides a funding offer detailing the amount, terms, and repayment structure.

- Capital Disbursement: Once accepted, the business receives funds, often within 24 to 48 hours.

- Revenue-Based Repayments: The repayment is made as a percentage of daily or weekly sales, ensuring flexibility in periods of lower revenue.

This structure makes forward funding an appealing option for businesses that require fast cash without the burden of fixed monthly payments.

Is Forward Funding Legitimate?

The most pressing question is: is forward funding legit? The short answer is yes, forward funding is a legitimate financing option. However, as with any financial product, it’s essential to work with reputable lenders. Here’s how to determine if a forward funding provider is trustworthy:

1. Check Licensing and Accreditation

Legitimate lenders are registered and comply with financial regulations. Ensure the provider is licensed and follows industry standards.

2. Read Customer Reviews and Testimonials

Customer experiences provide valuable insight. Look for online reviews, testimonials, and ratings to assess the credibility of the lender.

3. Understand the Terms and Conditions

Legitimate forward funding companies provide clear terms, including fees, repayment schedules, and potential penalties. If a lender is vague about these details, it may be a red flag.

4. Assess Transparency and Support

Trustworthy lenders will have a transparent process and responsive customer service. If you’re dealing with a company that avoids questions or pressures you into signing, proceed with caution.

Benefits of Forward Funding

Forward funding offers several advantages to businesses in need of capital:

- Quick Access to Funds: Unlike traditional loans that may take weeks to process, forward funding provides cash within days.

- Flexible Repayment Structure: Payments are based on revenue, so businesses aren’t burdened with fixed amounts during slow periods.

- No Collateral Required: Most forward funding providers do not require assets as collateral, reducing the risk for business owners.

- Easier Approval Process: Businesses with lower credit scores may still qualify for forward funding, as lenders focus on revenue rather than credit history.

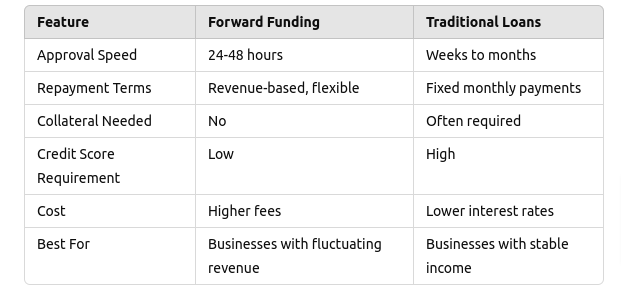

Comparing Forward Funding vs. Traditional Loans

Additional Considerations When Choosing Forward Funding

When selecting a forward funding provider, consider the following factors:

- Repayment Flexibility: Ensure the repayment terms align with your revenue fluctuations.

- Customer Support: A reliable lender should provide excellent support and answer all your queries promptly.

- Hidden Fees: Always read the fine print to understand any additional costs involved.

- Reputation: Research online and check for complaints or legal actions against the lender.

Risks and Considerations

While forward funding is a convenient financing solution, it’s important to consider the potential risks:

- Higher Costs: Forward funding often comes with higher fees compared to traditional loans.

- Frequent Repayments: Payments are deducted frequently (daily or weekly), which may impact cash flow.

- Potential for Scams: As demand for alternative financing grows, some fraudulent lenders offer misleading terms. Always verify legitimacy before signing agreements.

- Dependency on Revenue: Since repayments are tied to revenue, a slow sales period can prolong the repayment process, leading to higher total costs.

Is Forward Funding Right for Your Business?

If you’re still wondering is forward funding legit, the answer depends on your business needs and financial situation. Forward funding can be a great solution if:

- You need quick access to capital.

- Your revenue fluctuates and you require a flexible repayment structure.

- You want to avoid long approval processes and credit checks.

- You prefer a financing option that does not require collateral.

However, if you prefer lower interest rates and structured repayments, traditional financing options may be more suitable.

How to Apply for Forward Funding

Applying for forward funding is a straightforward process. Follow these steps to secure funding for your business:

- Research Lenders: Identify reputable lenders and compare their offers.

- Prepare Documentation: Gather necessary documents, such as revenue reports, tax returns, and bank statements.

- Submit an Application: Complete the application form and provide required financial details.

- Review Offers: Evaluate different funding offers and choose the one that best suits your needs.

- Sign Agreement and Receive Funds: Once you agree to the terms, sign the contract and receive funds in your business account.

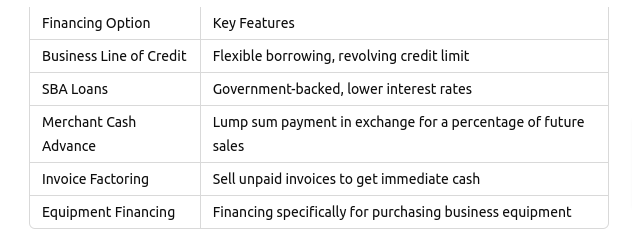

Alternative Financing Options

If forward funding does not seem like the right fit for your business, consider these alternative financing options:

Final Thoughts

Forward funding is a legitimate and valuable financing option for many businesses, provided they work with credible lenders. At Capital Express LLC, we specialize in providing reliable and transparent funding solutions to help businesses grow. If you’re considering forward funding and want to ensure you’re working with a trusted provider, contact us today to explore your options.

Still have questions about is forward funding legit? Reach out to our experts at Capital Express LLC for guidance on making the best financial decision for your business.